The truth is making sales isn’t easy, in fact selling to an existing customer is easier than selling to a new customer. That’s why it’s important to understand your customer lifetime values, as this metric determines how much money you expect from a customer on average.

What is Customer Lifetime Value (CLV)?

Customer Lifetime Value (CLV) is an important metric for businesses to measure the total revenue they can make from a single customer over the course of their shopping journey. CLV takes into account the whole value of a customer over time, factoring in their repeat purchases and the duration of their relationship.

By figuring out the customer lifetime value, businesses may determine how much they can afford to spend on bringing on new clients and keeping hold of current ones, making sure that their client acquisition expenses match the clients’ potential for long-term revenue.

Understanding your customer lifetime value (CLV) can have a big impact on your business strategy and help you focus on keeping your current customers rather than just getting new ones.

Why is Customer Lifetime Value Important?

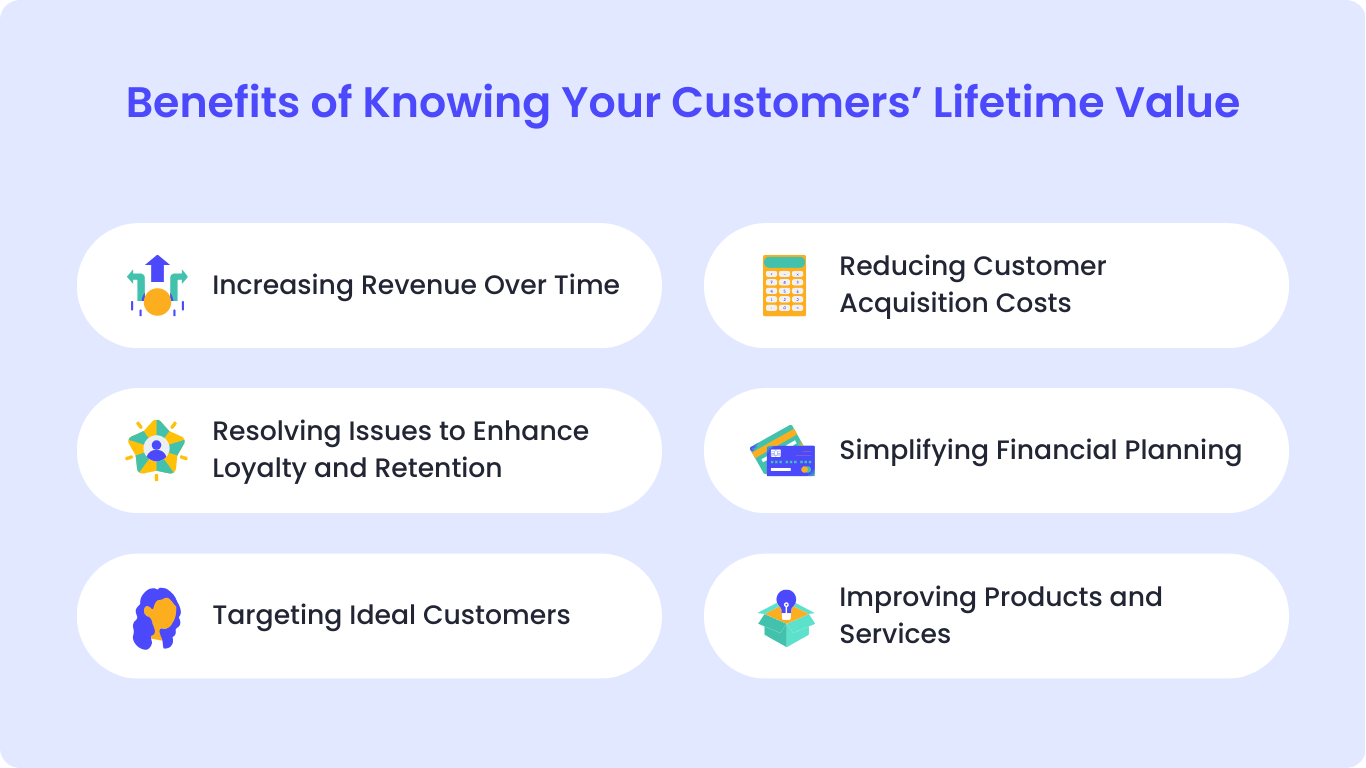

Knowing your customer’s lifetime value (CLV) and how long they usually buy from you will help you create better strategies for growth. Your customer acquisition, retention, support, and even product and service quality strategies can all benefit from using this statistic. These benefits include:

Increasing Revenue Over Time

Growing your revenue is strongly tied to growing your Customer Lifetime Value (CLV). A rising CLV means that clients are spending more throughout their association with your business, which means that your revenue streams are being constantly increased.

Resolving Issues to Enhance Loyalty and Retention

A thorough understanding of CLV can help you identify areas where customer satisfaction may be lacking. Addressing these concerns can build customer loyalty and retention, resulting in a steady and satisfied customer base.

Targeting Ideal Customers

CLV enables you to identify and understand your most valuable customers. This insight allows marketers to adapt their efforts and resources to attract and keep this ideal customer niche, resulting in more efficient and effective customer acquisition tactics.

Reducing Customer Acquisition Costs

By focusing on increasing the CLV, you can reduce the need to constantly acquire new customers. Retaining and increasing the value of existing clients might be less expensive than constantly investing in new customer acquisition.

Simplifying Financial Planning

CLV provides a clear view of the expected revenue from customers, making it easier to plan and allocate financial resources effectively. This clarity can help in budgeting, forecasting, and overall financial management.

Improving Products and Services

Analyzing trends in CLV can offer insights into how customers are responding to your products and services. This can guide product development and service enhancements to better meet customer needs and preferences, further boosting CLV.

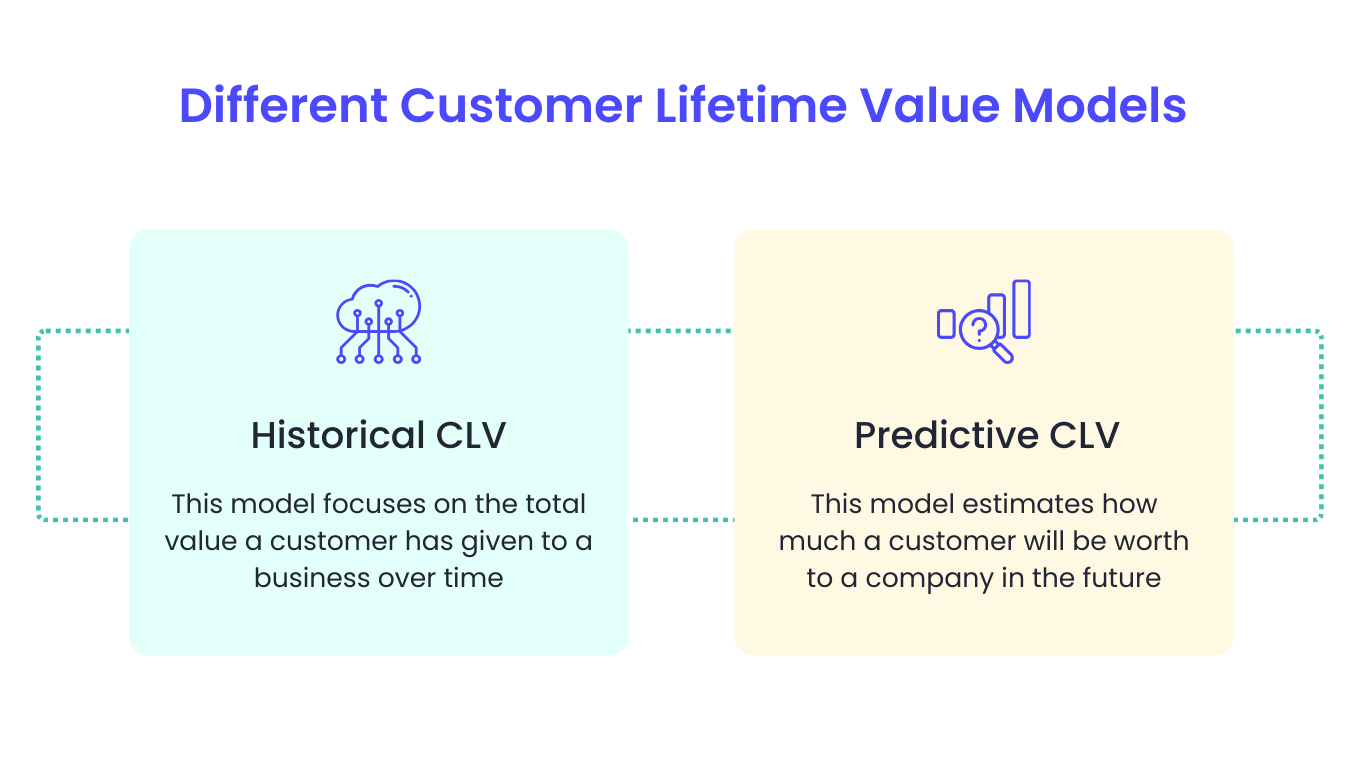

Different Customer Lifetime Value Models

Businesses frequently use two models to understand and maximize Customer Lifetime Value (CLV): the Predictive Customer Lifetime Value Model and the Historical Customer Lifetime Value Model.

Predictive Customer Lifetime Value

The Predictive CLV model estimates how much a customer will be worth to a company in the future. To produce these forecasts, it considers factors like past purchases and customer interactions with the company. This strategy helps firms prepare for the future by attempting to predict potential changes in consumer behavior and market trends.

Historical Customer Lifetime Value

The Historical CLV model focuses on the total value a customer has given to a business over time. It involves analyzing historical data to understand purchase frequencies, average transaction values, and the overall duration of the customer relationship.

How To Calculate Customer Lifetime Value

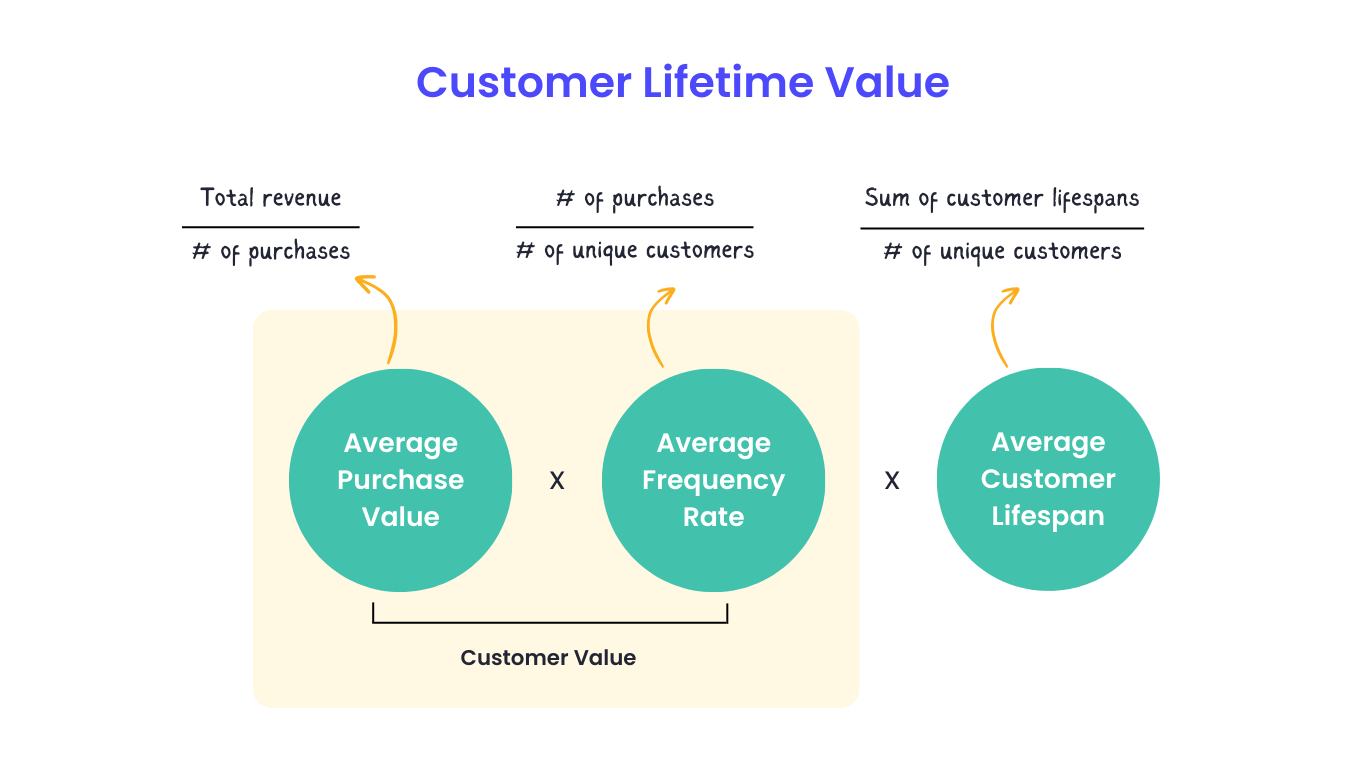

Calculating Customer Lifetime Value (CLV) gives businesses a clear understanding of the profit each customer brings over their entire relationship with the company. The calculation involves a few key steps, each building upon the last to provide a complete view of a customer’s value.

Step-by-Step CLV Calculation

Average Purchase Value: Calculate this by dividing your company’s total revenue over a set period (e.g., a year) by the number of purchases during the same period.

Example: If your business earned $100,000 last year from 1,000 purchases, your average purchase value is $100.

Average Purchase Frequency Rate: Determine how often an average customer buys from you in that period by dividing the number of purchases by the number of unique customers.

Example: If those 1,000 purchases were made by 250 unique customers, the average purchase frequency rate is 4.

Customer Value: Multiply the average purchase value by the average purchase frequency rate.

Example: With an average purchase value of $100 and a frequency rate of 4, the customer value is $400.

Average Customer Lifespan: Estimate the average number of years a customer continues purchasing from your business.

Example: If, on average, customers stick with your business for 3 years, that’s your average customer lifespan.

Calculate CLV: Multiply the customer value by the average customer lifespan. This gives you the CLV.

Example: A customer value of $400 over an average lifespan of 3 years results in a CLV of $1,200.

Real-World Scenario Example:

Let’s say you run a coffee shop. After analyzing your sales data, you find that the average customer spends $5 per visit and visits around 100 times a year. This means your average purchase value is $5, and your purchase frequency rate is 100. Your customer value is then $500 (5 x 100). If your customers typically keep coming to your shop for about 5 years, then your average customer lifespan is 5 years. Therefore, the CLV of a typical customer for your coffee shop would be $2,500 (500 x 5).

Strategies for Increasing Customer Lifetime Value

Implementing strategies focused on personalizing customer experiences, ensuring product and service excellence, and leveraging customer feedback can significantly increase CLV.

Personalization and Engagement

Customizing communications and offers to each customer’s unique requirements and preferences will promote loyalty and repeat business.

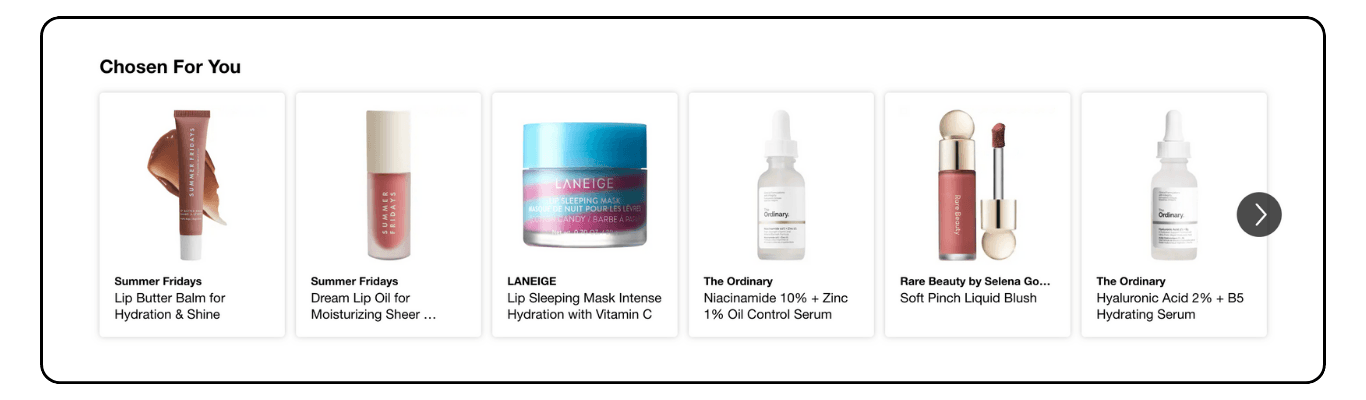

For example, leveraging client data to deliver tailored birthday offers or recommendations based on previous purchases can make customers feel valued and understood, improving the likelihood of future business.

Source: Sephora

Product and Service Quality

High-quality products that meet or exceed customer expectations can lead to positive word-of-mouth, repeat purchases, and a strong brand reputation.

Investing in quality control and continuous improvement methods ensures that consumers are satisfied and loyal over time, resulting in a greater CLV.

Customer Feedback

Surveys, reviews, and live chat widgets are examples of feedback methods that allow organizations to understand customer demands, identify areas for development, and respond to issues quickly.

Companies can build a sense of community with their customers by proving that their feedback directly influences changes and product development, resulting in improved loyalty and CLV.

Real-World Example:

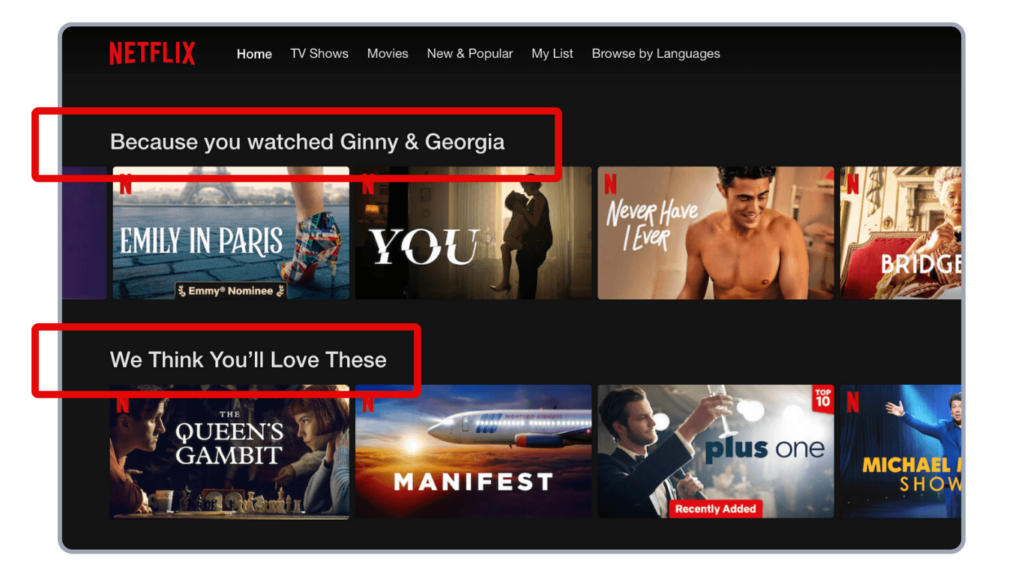

Netflix improves user engagement and satisfaction by using advanced data analytics to personalize suggestions for each subscription. Additionally, their dedication to offering diversified, high-quality content accommodates a wide range of tastes, guaranteeing client loyalty and satisfaction.

As demonstrated by its impressive subscriber growth and retention rates, Netflix has successfully raised its CLV by consistently incorporating user feedback into service enhancements and content choices.

Source: Netflix

Implementing Software that Increases Customer Lifetime Value

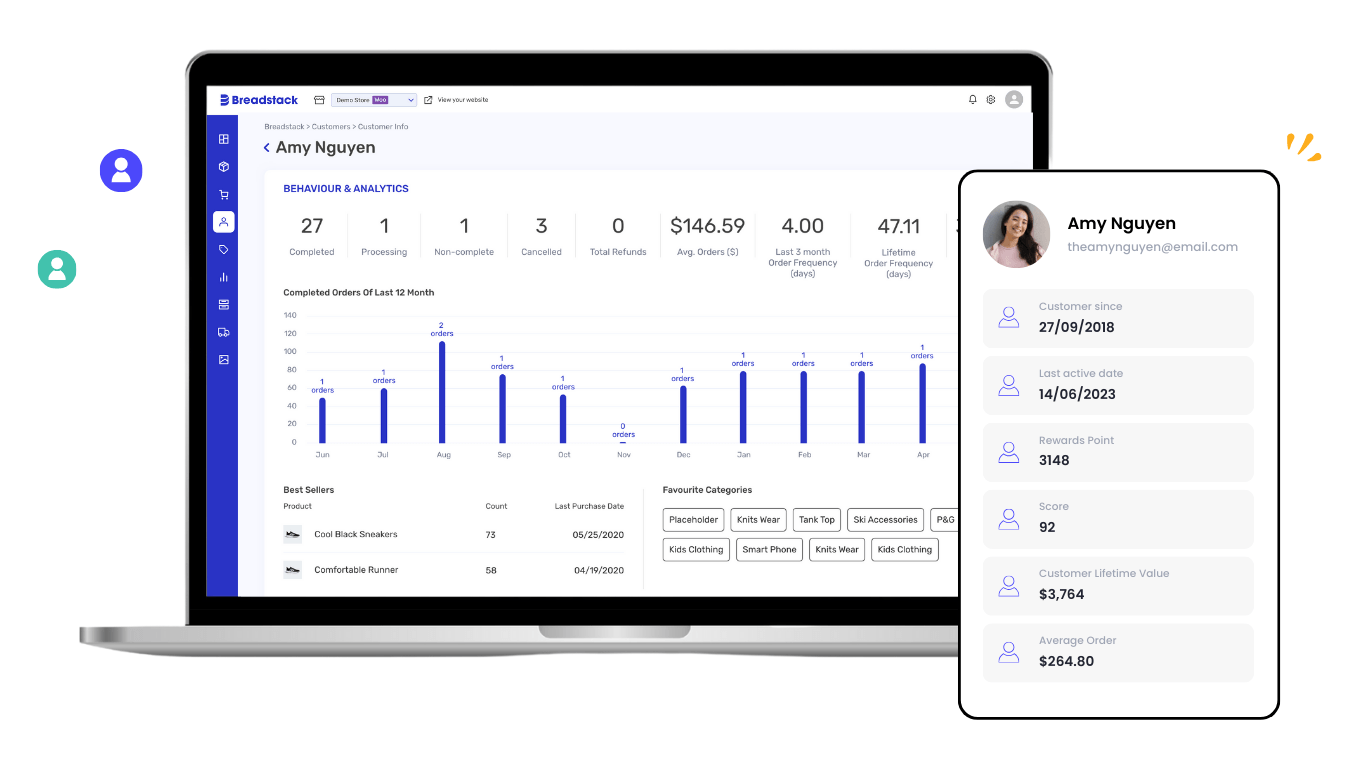

In the dynamic landscape of modern business, leveraging the right software can significantly amplify Customer Lifetime Value (CLV). Breadstack is an all in one solution that uses machine learning algorithms to automatically calculate CLV and create marketing campaigns.

By accurately predicting future buying behavior, Breadstack helps businesses tailor their strategies to nurture and retain high-value customers effectively.

Beyond CLV calculation, Breadstack serves as a full tech stack solution that empowers businesses to create engaging marketing promotions, segment customers for targeted communications, and deliver unparalleled personalization.

By delivering content, offers, and interactions that are tailored to the unique journey of each customer, Breadstack ensures that businesses can build deeper connections, driving loyalty and increasing the lifetime value of their customer base.