As a business owner, you’re well aware of the constant challenges and uncertainties that come with running a business.

While factors like sales, profit, and revenue are crucial to the success of any venture, there’s one vital aspect that often gets overlooked: cash flow.

In this article, we will explore the difference between revenue, profit, and cash flow, and shed light on the key business benefits of maintaining a healthy cash flow in your business.

What is healthy cash flow?

Healthy cash flow is the consistent and sufficient movement of cash into and out of your business.

It means having a positive net cash flow, where the inflow of cash from various sources exceeds the outflow of cash required to cover expenses and obligations.

In other words, healthy cash flow ensures that your business has enough cash on hand to meet its financial commitments, maintain operations, and pursue growth opportunities.

Differences between cash flow and other terms

To grasp the significance of healthy cash flow, it’s important to understand the distinctions between revenue, profit, and cash flow.

While these terms are sometimes interrelated, they represent different aspects of your business’s financial health.

Revenue

Revenue is the total amount of money generated from sales, either from products or services, within a specific period.

It represents the top line of your business and is crucial for evaluating the success of your sales efforts.

Profit

Profit is the amount left after deducting all expenses from your revenue.

It is a fundamental measure of your business’s financial performance and indicates whether your operations are generating positive or negative returns.

Profit provides insights into the efficiency and effectiveness of your business model.

Cash flow

Cash flow represents the movement of money in and out of your business. It measures the actual cash inflows and outflows over a specific period, reflecting the liquidity of your business.

Cash flow takes into account not only revenue and expenses but also factors such as accounts receivable, accounts payable, inventory, and investments.

Why is healthy cash flow important?

Maintaining a healthy cash flow is important for the long-term sustainability and growth of your ecommerce business.

Let’s explore some of the key benefits it offers:

Operational stability

A healthy cash flow provides you with the necessary liquidity to fund your day-to-day operations.

By having cash readily available, you avoid disruptions in your supply chain and maintain a seamless customer experience.

Financial flexibility

A good cash flow gives you the freedom to make better strategic decisions. It allows you to invest in new technologies, upgrade your infrastructure, and explore marketing initiatives that drive growth.

Having cash reserves also enables you to seize unforeseen opportunities, such as acquiring inventory at discounted prices or pursuing innovative ventures.

Financial flexibility positions your business as agile and adaptable in the dynamic ecommerce landscape.

Reduced reliance on debt

When your cash flow is healthy, you can minimize your reliance on external financing options, such as loans or lines of credit.

By avoiding excessive debt, you reduce the burden of interest payments and maintain control over your business’s financial decisions.

This independence provides you with greater flexibility and lessens the risk associated with indebtedness, ensuring your ecommerce business remains resilient during challenging times.

Supplier relationships

Having a healthy cash flow strengthens your relationships with suppliers. It can make it easier to negotiate favourable terms with suppliers, such as extended payment periods, discounts, or better pricing.

Strong supplier relationships, built on a foundation of healthy cash flow, can provide you with a competitive edge and open doors to new opportunities and partnerships.

Emergency preparedness

A healthy cash flow acts as a financial safety net, allowing you to navigate through crises or economic downturns with greater resilience.

It provides you with the ability to cover unforeseen expenses, manage cash shortfalls during slow periods, and continue operations even when faced with temporary setbacks.

By maintaining a buffer of cash reserves, you ensure your ecommerce business is prepared for any challenges that may arise.

Do you have a healthy cash flow?

Having a healthy cash flow is essential for the financial well-being of any business. Here are some key indicators and steps to determine if you have a healthy cash flow:

Positive cash balance

A positive cash balance means that your business is generating more cash from its operations than it’s spending.

This surplus allows you to cover expenses, meet financial obligations, and have funds available for growth or unexpected situations.

To achieve this, it’s crucial to carefully monitor your cash inflows and outflows on a regular basis, ensuring that your revenue consistently exceeds your expenses.

Operating cash flow ratio

The operating cash flow ratio measures your ability to cover short-term liabilities with cash generated from your day-to-day operations.

To calculate this ratio, divide your operating cash flow (net cash inflow from operations) by your current liabilities (short-term debts and obligations).

A ratio above 1 indicates that you have sufficient cash flow to meet your immediate financial responsibilities, which is a sign of a healthy cash position.

Quick ratio (Acid-test ratio)

The quick ratio assesses your ability to cover short-term liabilities using your most liquid assets (cash, accounts receivable) without relying on inventory.

To calculate this ratio the formula is Quick Ratio = (Cash + Marketable Securities + Accounts Receivable) / Current Liabilities

A ratio above 1 suggests that you can promptly meet your short-term obligations even if your inventory couldn’t be quickly converted to cash.

Get better cash flow with Breadstack

Breadstack is here to help. We offer many tools to help optimize every aspect of your operations and improve cash flow.

Here are some products we offer that help with cash flow.

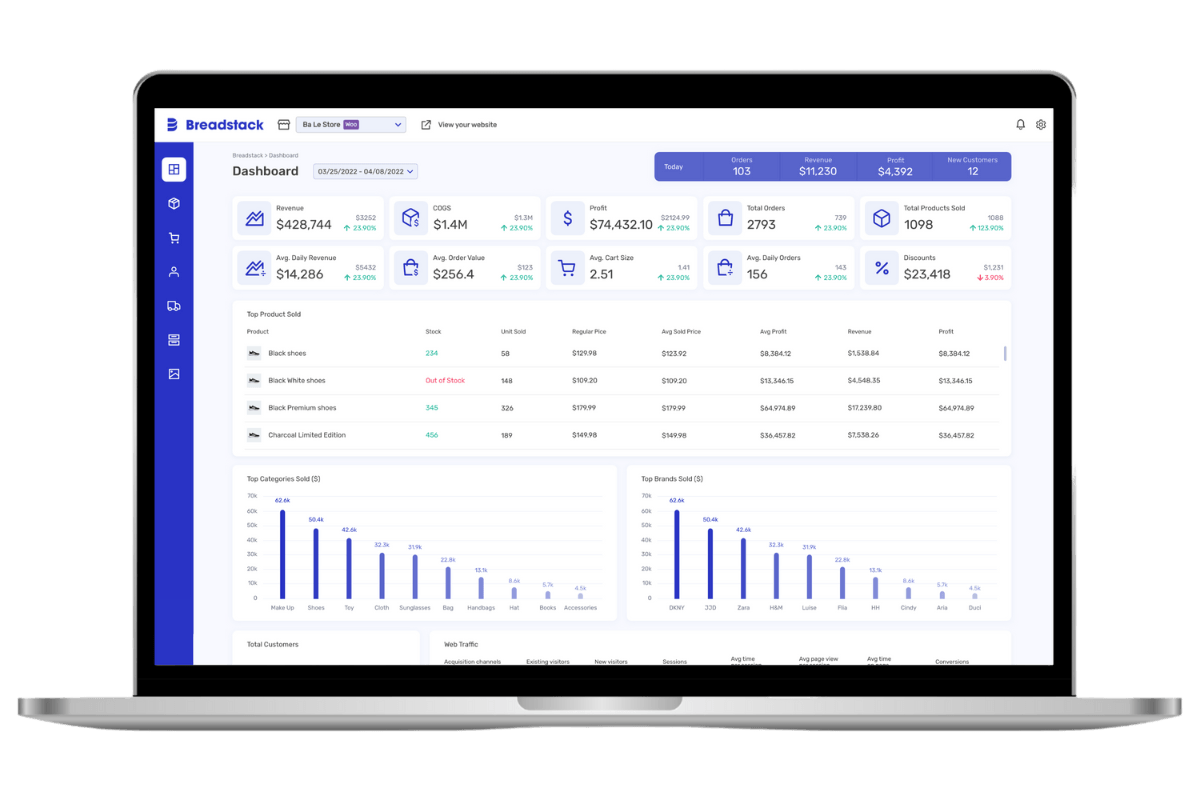

Commerce Hub

Breadstack’s Commerce Hub helps you save time, grow your business and compete with giants. Gain access with all the information you need to manage your online store.

Increase your cash flow and keep money in your business.

Commerce Hub lets you…

- See the results of your past pricing changes and marketing campaigns to clearly understand the impact of promotional efforts

- Powerful reporting for product turnover performance, sell through rates, and days on hand highlights products to sell off, your top performers, and in high demand.

- Make informed decisions about the business rather than guesses based on intuition, and know your actions will lead to results

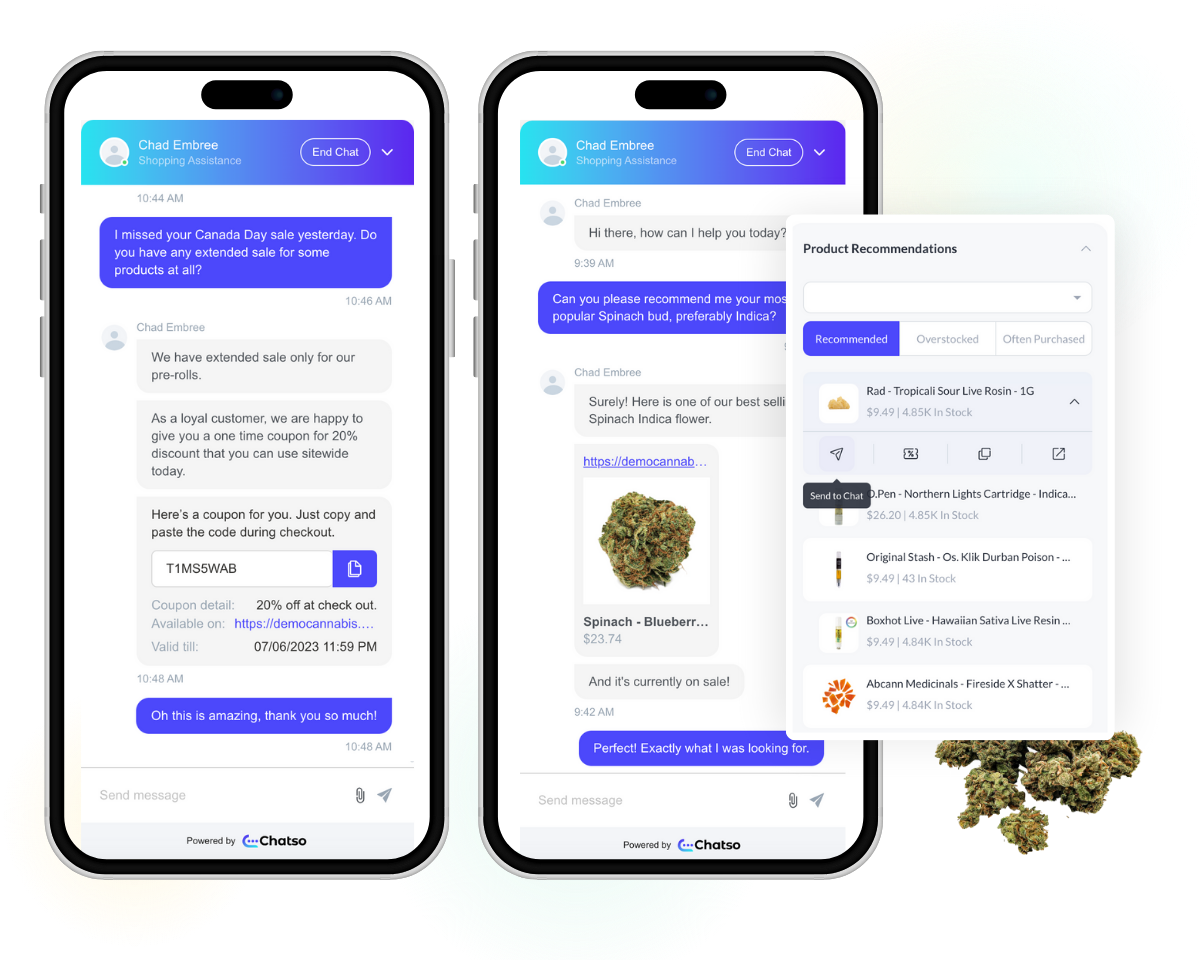

Chatso

Breadstack’s Chatso helps with support, sales and service. It’s a human-powered, AI-assisted customer service solution.

Chatso lets you provide the same level of customer service from in-store to online, delight at the right moment with proactive engagement, and improve your website sales.

Improve your cash flow with a new sales channel.

Chatso lets you…

- Free up your cash flow by offering on-the-spot promotional discounts to clear out underperforming or excess products

- Combine personal preferences with coupons to drive conversion and orders

- Customers that are able to get support right away are more likely to convert and not walk away from purchases

- Insight into customer lifetime value to indicate if you’re speaking to a loyal customer or a deal hunter

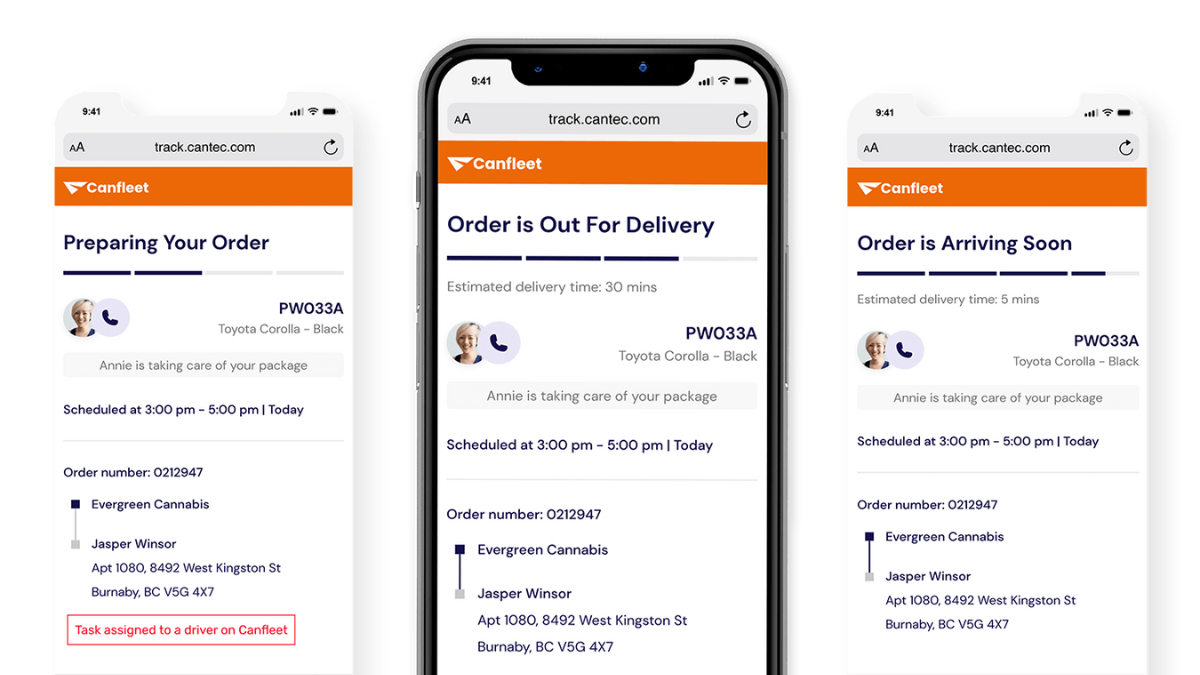

CanFleet

CanFleet helps scale your business, expedite your deliveries, and delight your customers wherever they are with the fastest delivery times at the most affordable prices.

Its software made simplify the complexities of last-mile delivery.

CanFleet lets you…

- Make each trip more valuable with multiple pick-ups and deliveries on the same journey

- See where all your drivers are, their destination, next tasks, and what is in transport

- Know exactly what you need to charge customers for delivery based on weight, size, distance, and priority

- Full reporting on drivers, tasks, commissions, past orders and deliveries in-progress

Take care of your cash flow

Revenue and profit are vital indicators of your ecommerce business’s success. However, they alone cannot sustain its long-term growth.

A healthy cash flow is essential for ensuring operational stability, financial flexibility, and the ability to weather unforeseen challenges.

Prioritizing a healthy cash flow allows you to seize opportunities, invest in growth, and build a strong foundation for sustained success in the dynamic and competitive business landscape.